As published in

In the twenty years since Poland joined the European Union, the nation has evolved beyond recognition. The journey from emerging economy to European powerhouse has seen Poland dubbed the “Tiger of Europe”, as three decades of uninterrupted growth—the longest in European history—have produced a 40% rise in GDP, positioning the country as a cornerstone of regional progress.

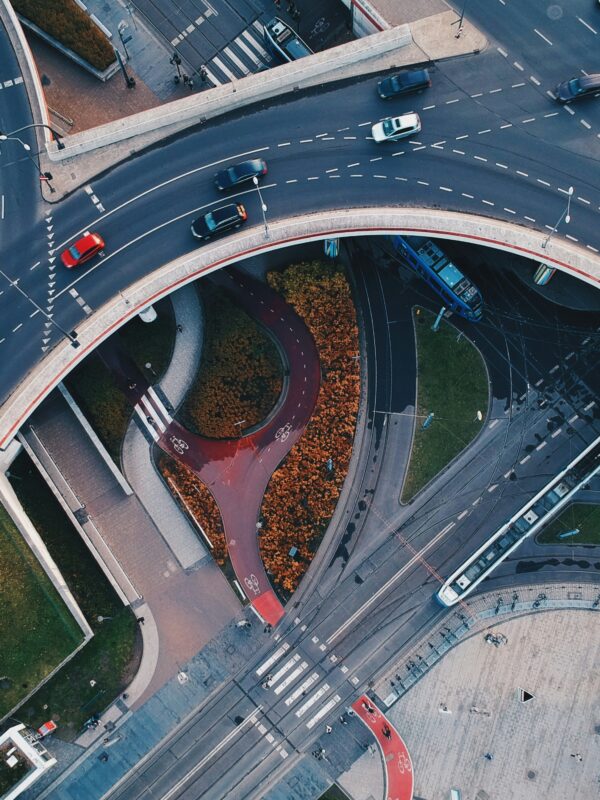

From January to June 2025 Poland assumes the Presidency of the Council of the European Union for the second time—with Prime Minister Donald Tusk hailing it as a “breakthrough” year for Polish economic development and leadership in Europe. Top of the agenda is championing European security in all its dimensions: internal, external, information, economic, energy, food and health. Infrastructure, integral to these objectives, will be a key focus. “Infrastructure functions like the circulatory system of an economy,” says Minister of Infrastructure Dariusz Klimczak. “The Ministry of Infrastructure is like Rome: all roads lead here, and we are driving the country forward.”

Robust infrastructure spending underpins Poland’s economic achievements, connecting markets and attracting inward investment. The Central Transport Hub (CPK) project, a state-ofthe-art initiative integrating air, rail and road transport to create a modern national transportation system, exemplifies Poland’s ambition in this area. Scheduled to include a new airport between Warsaw and Łódź alongside a high-speed rail network, the CPK will solidify Poland’s position as a gateway for regional and international trade.

Economic forecasts reflect this momentum. Poland’s GDP is projected to grow by 3.6% in 2025, according to the European Commission, driven by private consumption and investment, including EU-funded public investment. Central to this economic dynamism is Poland’s partnership with Germany, its largest trade and investment partner for more than twenty years. The German Council on Foreign Relations notes that Germany accounts for 20% of Poland’s foreign direct investment, highlighting the extent and importance of bilateral ties. “We aim to build solid connections and partnerships between Poland and Germany in every sector, including infrastructure,” says Klimczak. “One key focus is fostering cooperation on cross-border projects,” he continues, emphasising the importance of enhancing existing connections, such as the link from Poznań to Berlin, and creating new ones. “It is essential we provide opportunities for businesses on both sides of the border to initiate and develop joint projects.”

Poland’s appeal as an investment destination extends beyond its large internal market. The nation’s strategic

approach to EU membership has driven economic modernisation, with EU funds financing transformative projects in transport, energy and digitalisation. Initiatives like the Vistula Spit canal, enabling direct maritime access to the port of Elbląg, highlight Poland’s ability to leverage infrastructure for economic and geopolitical advantage. Meanwhile, the country’s growing defence and security role creates opportunities right across the economy.

It is in this context that Poland rose 10 places to sixth in EY’s European Attractiveness Survey, ranking investment appeal, noting the country is also benefitting from macroeconomic trends such as nearshoring and supply-chain reorganisation. “Poland is an excellent destination for investment,” Klimczak concludes. “Our country offers great potential for business opportunities.”

The Polish economy’s strong rebound in 2024 saw GDP rise by 2.9% for the year, while the European Commission forecasts a 3.6% increase in 2025, marking the country’s return to its long-term growth trend. Powered by a robust labour market and rising wages that are fuelling domestic demand, the nation’s economic momentum looks set to be bolstered further by defence spending, energy transition initiatives and significant EU funding. The cumulative effect of these dynamics, in the view of the European Bank for Reconstruction and Development, is that in 2025, “investment demand will surge.”

Government plans to increase renewables to fifty percent of national energy supply have seen a raft of measures designed to facilitate investment in the sector, including a €4.79 billion financing programme for offshore wind farms and regulatory changes to make it easier to locate onshore equivalents. Meanwhile, an expected upturn in the EU, particularly Germany, is likely to provide further economic impetus, notably in manufacturing and exports.

The largest industrial real estate developer in Europe, Panattoni offers direct investment opportunities in logistics and industrial facilities across the continent.

Panattoni has been the dominant European logistics developer for the last eight years and has delivered more than 22 million square metres to date. The business was founded in 2005 in Poland, where the high growth potential and lower development costs made it an ideal market for a development company focused on production, logistics, and e-commerce. “Poland is where we have historically built the most space,” explains Robert Dobrzycki, CEO and Co-owner. “We have developed over 50 percent of Poland’s existing warehouse and production facilities.”

Panattoni’s interests have expanded steadily over the last two decades, spreading across mainland Europe and beyond, with Germany rapidly becoming its second-largest market. Poland’s proximity and efficiency make it an invaluable supplier to Germany—the countries’ close collaboration is a significant factor in their mutual success. Much of the company’s recent growth was driven by the e-commerce sector, which continues to show strong long-term potential, but the trend for nearshoring is also impacting the sector, as companies look to shift operations closer to customers. “Our approach is strategic,” says Dobrzycki. “We prioritise building a robust platform that delivers substantial space, supports clients and investors globally and leverages deep local expertise.”

CEO and Co-owner Robert Dobrzycki shares his thoughts on the factors behind Panattoni’s success and describes his ambitions for the company’s future.

Q: What differentiates Panattoni from its competitors?

We are a large, privately owned global company. This benefits clients and investors by providing access to extensive business opportunities, international reach and diversified investment options.

Q: What growth areas is Panattoni targeting?

Globally, our focus is on expanding into underrepresented areas, particularly in Western Europe and Asia. We have recently entered Saudi Arabia and are considering the UAE, while continuing to grow in India and push further east.

Q: Why is the German market important for Panattoni?

We value Germany as a strategic market. It is a large, diverse, and wealthy economy with exceptional infrastructure, major ports, and significant consumption. Its central location in Europe makes it a prime hub for business.

Q: What opportunities does Panattoni offer investors?

We aim to build strategic, long-term partnerships with clients and investors, avoiding opportunistic, one-off transactions. Our focus is on trust and value, offering consistency Wand reliability across all markets we serve.